Bored Apes just proved that there is only one way to guarantee Web3 royalties: hardwire them into every single transaction, on-chain at the protocol level, on a chain custom built for nonfungible tokens (NFTs). Only this root level tech solution can work; every superficial economic and legal solution in the last two years has failed.

Yuga Labs, developers of the marquee Bored Apes NFT collection, called out NFT marketplace Opensea after it made royalty enforcement optional.

Yuga’s CEO Daniel Alegre emphasized: “Yuga believes in protecting creator royalties so creators are properly compensated for their work.” Opensea cited lack of “opt-in by the entire ecosystem,” arguing it cannot be the only platform enforcing royalties when the rest of the market evades these.

If Bored Apes Yacht Club has to call out Opensea on royalties, you know royalties cannot be left to platforms and creators to enforce. #IYKYK

Clearly, royalties cannot be left to creators and platforms to enforce. Given a choice, individual holders are incentivized to pay as little as possible. Let someone else pay creators.

Thus, the only way for creators to protect themselves is to build on chains that do not give anyone a choice. The only guarantee is a chain that requires everyone to pay creator royalties—hardwired in every single transaction, on-chain at the protocol level, not left to marketplaces. This is a key tech solution envisioned in Enjin Blockchain and its protocol level NFT functions.

Royalties are an economic and legal issue, but Web3 royalties require a tech solution.

Step back and understand the Web3 context.

NFTs are unique sets of data—art, video, music, in-game items—that make genuine digital ownership and new economic and community models possible. But the practical dilemma is, how do you pay for all this beautiful creation?

There are two obvious ways.

The first and simplest is to pay up front. In NFT terms, this is a mint price. Make the first holders pay to receive new NFTs.

This has caused endless problems. Simply and most obviously, creator and holder interests are completely opposite.

Creators want to be paid as much as possible up front, but have no incentive to work once they get the money. Holders want to get as much as possible built before paying.

Paying up front at mint might work for simple 1/1 digital art pieces, but is impossible to manage for NFTs that aspire to be more.

Witness the recent, intensely criticized Azuki Elementals mint. Azuki was then the most prominent PFP (profile picture) NFT collection after Bored Apes. Azuki launched the 20,000 piece Elementals collection with a mint price of 2 Ether last June 27, 2023, to add to the 10,000 piece main Azuki collection. Azuki raised US$38 million from the Elementals mint, up front.

But Elementals failed to live up to the hype. The intensely vocal Azuki community criticized the art as too similar to the original collection, and complained about certain mint mechanics. If Azuki prices reflect faith in shared brand value, the “floor” price fell about 80% from about 17 Ether on June 24 to about 3.5 Ether on August 21. Elementals likewise fell almost 80% from the 2 Ether mint price.

This disappointment amplifies creator-holder conflict of interest. Azuki was accused of a rug pull and scam for taking US$38 million up front, but leaving holders disappointed by the initial product and unclear on what else they would receive after paying up front.

But while the problem of a high mint price (such as 2 Ether in mid-2023) is obvious, there are two other equally obvious problems.

First, a low mint price is just as problematic. If Elementals had a 0.02 Ether mint price instead and sold for US$380,000 instead of US$38 million, Azuki would not have the resources to build anything.

Second, almost no new project can sell out or mint out with a 2 Ether price, much less a large 20,000 piece collection at that price. Most new projects will not even have the luxury of considering a high mint price—no one will buy.

TLDR – If Azuki failed with a high mint price strategy, most projects will also fumble.

Royalties are the second solution. In addition to paying for new NFTs at mint, holders can pay 5% (or whatever other percentage) each time NFTs are resold. NFTs can even be minted free if creators can rely on later royalties.

Reliable royalties align creator and holder interests, instead of the extreme conflict of interest of high mint prices.

First, mint prices can be left reasonable, making them affordable for normal NFT fans and giving creators a larger market.

Second, royalties are future, sustainable revenues, meaning creators are encouraged to develop a collection instead of stopping (or having to launch new NFTs) when they feel they have delivered enough value. As long as a collection keeps its value, creators will keep earning and can keep building.

Third, royalties allow creators to share in value grown after mint. If creators depend solely on mint prices, they would not share future increases in value unless they keep some NFTs for future sale. With royalties, creators earn more as NFTs are resold at higher values.

Fourth, royalties allow new economic models. Beyond PFPs, imagine NFT membership cards where royalties from resales generate revenue even if no new memberships are sold.

Thus, royalties create better models than holders choosing to pay high mint prices and hoping creators deliver, or to simply not buy high priced NFTs.

The problem is these models are only possible if creators can be assured of royalties.

Obviously: low mint prices + no royalties = dead projects.

To repeat: Royalties are an economic and legal issue, but Web3 royalties require a tech solution.

The economic issue, again, is obvious. Creators want to be paid as much as they can charge at mint. Holders want to pay as little as they can get away with.

The legal issue is enforcement. Creators cannot possibly sign a legal agreement with every holder or even every marketplace to enforce royalties, and creators cannot chase after every transaction with unpaid royalties.

Animoca Brands has emphasized the legal aspect for royalties, with pre-made license templates for creators. These are wonderful but not complete solutions unless they can be seamlessly enforced in every transaction without creators having to wave the license and chase after every transaction with unpaid royalties. (But imagine Enjin Blockchain having legal licenses on-chain in the future…)

Thus, royalties become a tech issue because an ironclad tech solution is the only practical way for creators to be assured of royalties. Code needs to become law and deliver royalties.

But if code is law on blockchain, what is the problem?

The problem is indeed code.

Code has not protected royalties.

Most NFTs are on Ethereum (and Enjin began on Ethereum; co-founder Witek Radomski authored the ERC-1155 NFT standard). Ethereum, though, was broadly intended for many things and NFT functionality was added on much later through various smart contracts.

Thus, royalties have to be enforced via smart contract.

TLDR: Platforms and holders keep finding loopholes to avoid Ethereum smart contract royalties.

In August 2022, NFT marketplace X2Y2 made royalties optional, followed by Magic Eden in October 2022. The royalties debate spiked after newcomer Blur overtook Opensea in NFT volumes in December 2022, and likewise made royalties optional.

The conflict of interest for marketplaces is obvious. Marketplaces gain business the happier traders are. Marketplaces have less incentive to make creators happy because creators are not the direct customer, even though there would be no marketplaces without creators.

Given a choice, marketplaces should prefer to not enforce royalties so there would be more sales at lower prices. As Opensea tried to defend itself, a marketplace that tries to enforce royalties when others do not is fighting the market and acting against its own interests.

For holders, noble philosophies about royalties are quickly forgotten if you can buy a NFT 10% cheaper on a royalties optional marketplace.

Clearly, marketplaces and holders are incentivized not to enforce royalties if given a choice. Thus, platform and holder level enforcement is impossible and only punishes those who honor royalties by choice. (The is a classic “free rider” problem in economics.)

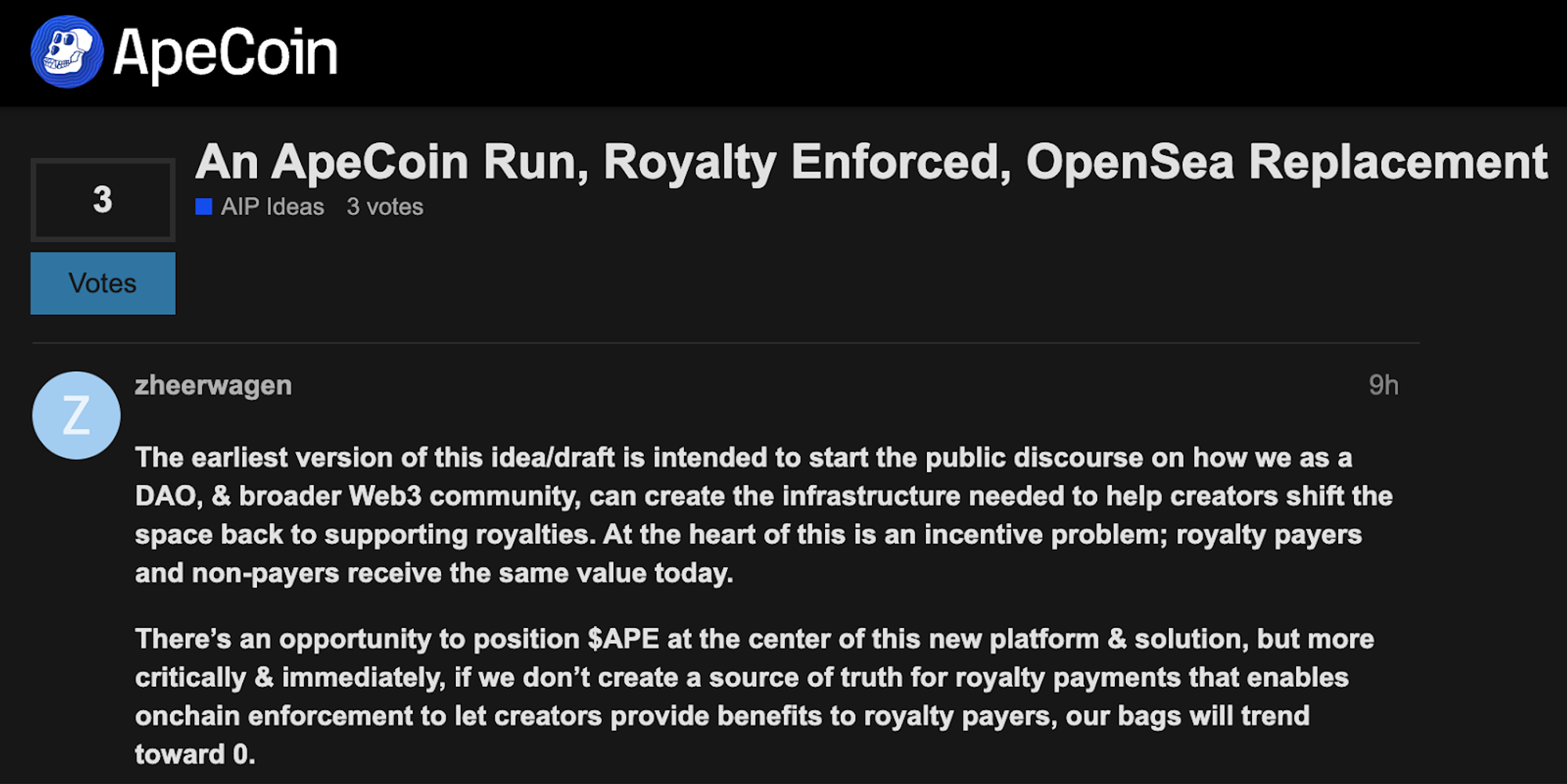

Bored Apes is debating its own exclusive marketplace where royalties can be enforced and they can attempt to block other marketplaces. This is hardly a perfect solution because most collections are not in a position to attempt this and need to tap the audiences of established marketplaces. Besides, it is a centralized solution for what is supposed to be a decentralized product, and goes back to walled gardens in what is supposed to be an open metaverse.

Going one level below marketplaces, smart contract level enforcement has also been problematic. Skipping the details, NFT smart contracts are not universal or uniform and platforms keep finding loopholes to avoid royalties at the smart contract level. It is simply too cumbersome to enforce royalties at the smart contract level and keep tweaking enforcement tools and filters to keep plugging loopholes.

(And there is room for loopholes because a holder should be able to transfer a NFT to another wallet he owns, such as a cold or vault wallet, without paying royalties. Royalties enforcement tools need to distinguish this from more complex transfers for marketplace sales.)

The most straightforward solution is thus to go another level down and enforce royalties right at the protocol level. This means, ideally, royalties are enforced in every transaction because they are enforced by the chain itself. Royalties, ideally, should be hardwired into the chain’s NFT functions. Doing this at the protocol level means they are built into the chain, and are not just added smart contracts.

This is a straightforward and effective solution because, obviously, royalties would be enforced across the entire chain, in every transaction. No one is given a choice and everyone using the chain has to pay creators properly.

There can be no loopholes if royalties are on-chain.

Obviously, this is not possible with Ethereum today. It is only possible with a chain custom built with NFT functions at the protocol level, including royalties enforcement. It is only possible with a chain custom built with creators in mind from the beginning.

This is the vision behind Enjin Blockchain and emphasizes why having NFT functions such as royalties at the protocol level are a crucial gamechanger.

Oscar Franklin Tan (@OscarFranklnTan), CFA, is the Chief Financial Officer and Chief Legal Officer of Atlas Development, a core contributor to Enjin Blockchain. He enjoys philosophizing over economic, legal and tech dilemmas, and browsing NFT traits and mid-rares. He still prefers the original Azuki art over Elementals (holds #3879, #1490).