Decentralized finance (DeFi) is the growing realization of a long-held vision for blockchain technology: a financial ecosystem that does not rely on any centralized entity or institution.

This is made possible by a system of smart contracts that automatically execute an action when certain conditions are met. DeFi sort of functions like a bank—except no bank is actually involved at all. With DeFi, automated loans can be negotiated between complete strangers according to the rules set by the smart contracts.

By not relying on a centralized institution like a bank, DeFi allows people to earn higher yields on deposits, borrowing with ease and without worry of discrimination or other issues that may come along with trying to take out a loan at a traditional bank.

Today, we are excited to make our entry into this DeFi space, as Enjin Coin (ENJ) is now supported in the Aave Protocol!

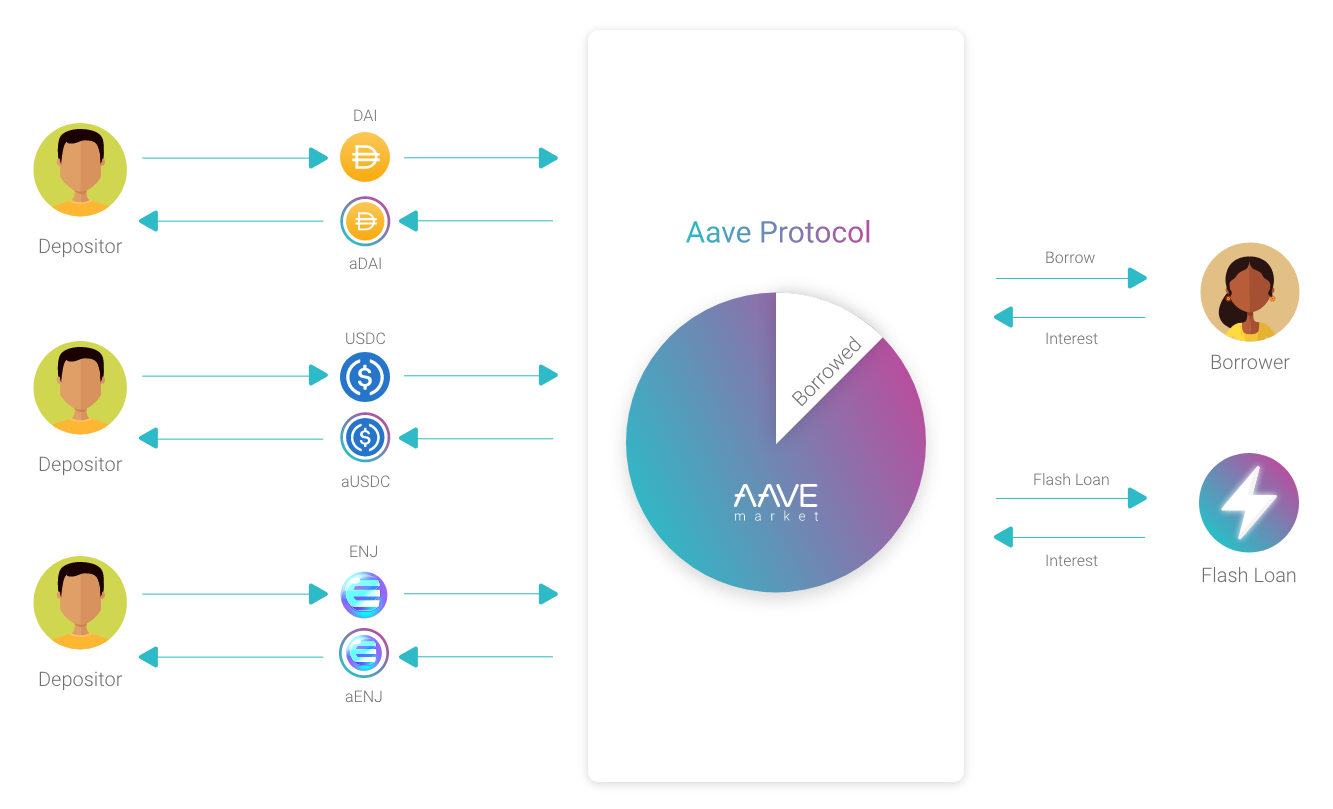

Aave is a smart-contract governed lending pool on the Ethereum blockchain where users can earn interest on and/or borrow assets against their deposits.

An open source and non-custodial series of smart contracts, Aave is completely transparent, traceable, and auditable by anyone.

In the six months since its launch, Aave has quickly grown to manage $250 million in deposited cryptocurrencies/digital assets.

Depositors earn interest by providing liquidity to lending pools, and borrowers can obtain loans by tapping into these pools with variable and stable interest rate options, as long as they can put up enough collateral in another asset to borrow against.

Developers can even borrow instantly and without needing collateral by executing a "Flash Loan," where liquidity is borrowed and returned to the pool within a single block transaction. If the liquidity is not returned, the action gets reverted, effectively undoing the loan and returning the liquidity to the pool.

The interoperability with other projects running on Ethereum provides financial composability, meaning DeFi can be viewed as many "money legos," allowing developers to draw on the best solutions available and quickly build on existing foundations.

The team behind Aave are some of the earliest pioneers in this DeFi space, having developed ETHLend back in 2017, a project which introduced peer-to-peer loans to the Ethereum ecosystem.

You can now leave your ENJ in the Aave Protocol and earn interest as other people borrow your coins—all controlled by immutable, transparent smart contracts on Ethereum with accurate price feeds secured by Chainlink's decentralized oracle service!

Your ENJ is secured by the other cryptocurrency assets left in the Protocol as collateral. Essentially, blockchain code becomes your bank manager. Everything is trustless, and no personal information is disclosed.

In turn, you can also use your own deposited ENJ as collateral to borrow other coins.

With the addition of ENJ, there are currently 18 different assets available to be deposited and borrowed in the Aave Market. These assets can be used as collateral when you borrow, with the exception of USDT, sUSD, and SNX.

Interacting with the Aave Protocol can be done right from the Enjin Wallet:

You're now ready to go!

While growing quickly, DeFi is still a relatively young industry.

As always, when interacting with pioneering technology, we strongly recommend that you DYOR (do your own research).

For those interested in security, you can head over to Aave’s security page to view audits completed by Trail of Bits, Open Zeppelin, and Consensys Diligence.

To view analytics and rankings for the top DeFi protocols and applications, we recommend DeFi Pulse as a good resource.

In Aave, deposits are tokenized as “aTokens”—interest-bearing tokens that are pegged 1:1 to the underlying asset.

For example: when you deposit 100 ENJ, you receive 100 aENJ.

These aENJ tokens accrue interest in real time—directly in your wallet—so you can see your aENJ balance increasing by the second.

aENJ can be reclaimed from the Aave Protocol for your corresponding ENJ at any time.

You can also borrow ENJ, as long as you put up another asset as collateral.

When borrowing, it is important that your loan remains overcollateralized (your deposited collateral is significantly higher than your loan).

Should this change (e.g., if the price of your collateral asset goes down, you withdraw some collateral, or the price of borrowed asset goes up), then you risk your position being liquidated, meaning you would lose your collateral assets in order for the pool to support the value of your loan.

While growing quickly, DeFi is still a relatively young industry.

As always, when interacting with pioneering technology, we strongly recommend that you DYOR (do your own research).

For those interested in security, you can head over to Aave’s security page to view audits completed by Trail of Bits, Open Zeppelin, and Consensys Diligence.

To view analytics and rankings for the top DeFi protocols and applications, we recommend DeFi Pulse as a good resource.

When borrowing assets, it is important to bear in mind liquidation risk, when your assets are claimed by the DeFi protocol in order to maintain the security of your loan. Aave provides tools to monitor this status, like showing your loan's "health factor" (make sure to keep this above 1 to avoid getting liquidated).

The Aave Risk Team has also published a comprehensive Risk Framework outlining the risks associated with every asset in the Aave Protocol and the measures in place to alleviate them.

Being added to the Aave Protocol provides new utility for ENJ and marks the start of an exciting journey of our token into one of blockchain’s fastest growing applications.

For those both familiar and unfamiliar, there is much to watch for in the burgeoning DeFi space!